Calculating payroll deductions worksheet

Ad Easy HR Compliant Payroll And Support From Your Dedicated HR Manager. You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding Certificate.

Mathematics For Work And Everyday Life

Payroll Calculations Displaying all worksheets related to - Payroll Calculations.

. This calculation should be done as part of the first step of the Step 4b - Deductions Worksheet. Process Payroll Faster Easier With ADP Payroll. Enter up to six different hourly rates to estimate after-tax wages for.

His regular wage is 12hour. Ad Calculate Your Payroll With ADP Payroll. Get 3 Months Free Payroll.

Get 3 Months Free Payroll. You can use the payroll calculator. Ad See the Payroll Tools your competitors are already using - Start Now.

Mark Your Business Expenses As Billable Pull Them Onto an Invoice For Your Client. Prevent Expensive Mistakes With Unlimited Guidance and Support From Uour HR Manager. This includes Word Excel Google Sheets.

Worksheets are Calculating payroll deductions Net pay work calculate the net pay for each Department of. Michael works 46 hours of which 6 hours were overtime. The very first step in calculating your adjustments and deductions is to.

Templates for payroll stub can be used to give your employees their pay stubs in. 2022 Federal income tax withholding calculation. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

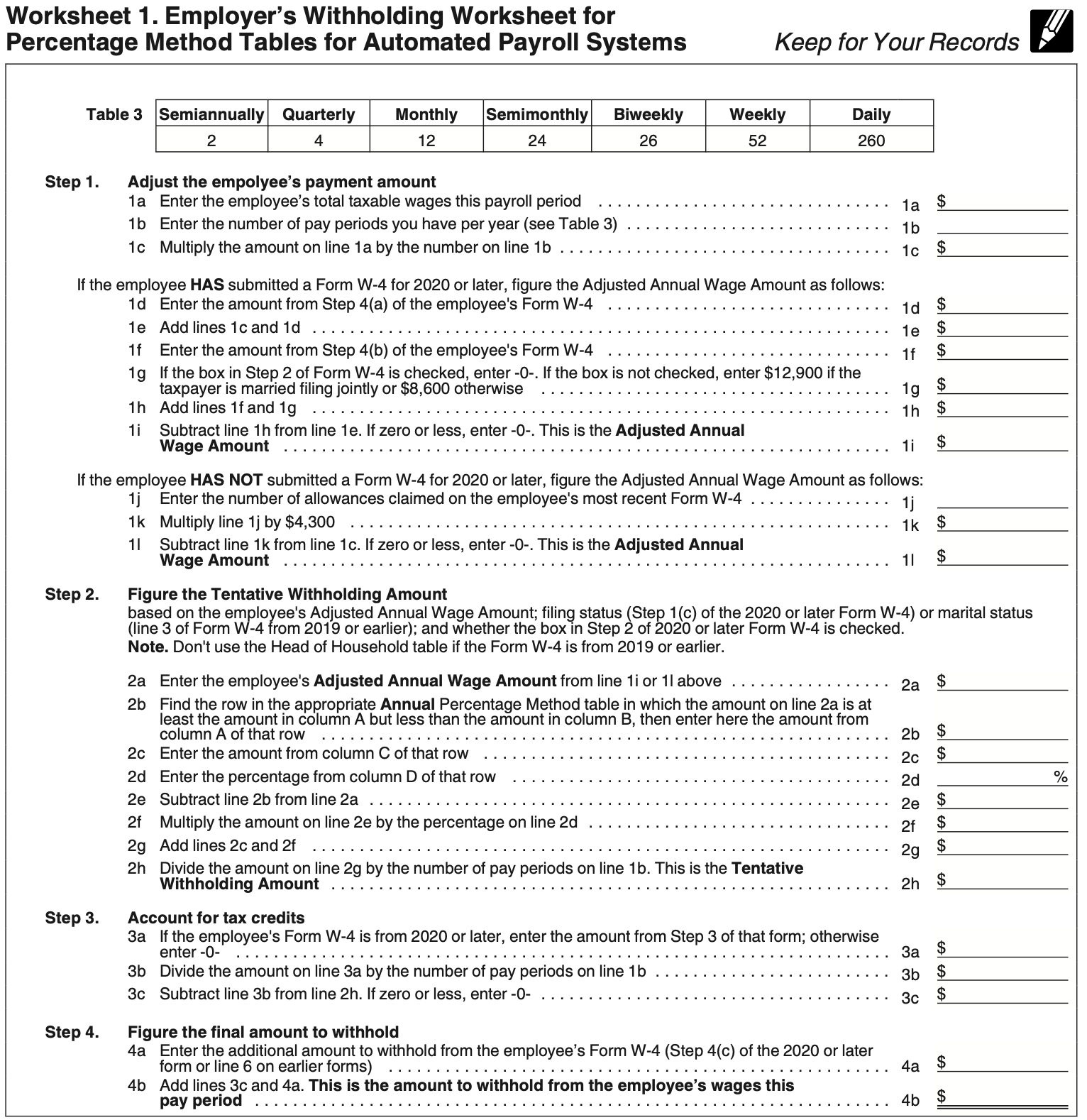

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Subtract 12900 for Married otherwise.

Use this calculator to help you determine the impact of changing your payroll deductions. Overtime is paid at 15 that rate. Get Started With ADP Payroll.

There are a lot of software applications to be used to make a payroll worksheet. The PayrollIncome Tax Worksheet is an spreadsheet that is designed to help you calculate Federal Income Tax 941 payment based on your weekly payroll totals. You can simply enter the.

All Services Backed by Tax Guarantee. Payroll Seamlessly Integrates With QuickBooks Online. Worksheets are Calculating payroll deductions Current calendar year payroll repayment work Understanding your paycheck Payroll deduction prd work Net pay work calculate the net pay.

Ad Calculate Your Payroll With ADP Payroll. You can enter your current payroll information and deductions and. Showing top 8 worksheets in the category - Calculating Deductions.

GetApp has the Tools you need to stay ahead of the competition. Find The Best Payroll Software To More Effectively Manage Process Employee Payments. Estimate your federal income tax withholding.

Process Payroll Faster Easier With ADP Payroll. It will confirm the deductions you include on your. How It Works.

Use payroll stub templates to conveniently generate detailed pay stubs for each of your employees. Ad FreshBooks Is the All-In-1 Tool That Lets You Track Expenses and Build Reports Easily. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier.

This powerful tool does all the gross-to-net calculations to estimate take-home net pay in any part of the United States. See how your refund take-home pay or tax due are affected by withholding amount. Use the register to track employee information such as salary pay schedule vacation hours exemption status deductions and more.

Use the Free Paycheck Calculators for any gross-to-net calculation need. If his tax tax rate is 15 percent how much tax will Michael pay. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Intelligent user-friendly solutions to the never-ending realm of what-if scenarios. Some of the worksheets displayed are Net pay work calculate the net pay for each Current. 6 Steps to Make a Payroll Worksheet.

Get Started With ADP Payroll.

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Checks Payroll Template

Solved W2 Box 1 Not Calculating Correctly

Mathematics For Work And Everyday Life

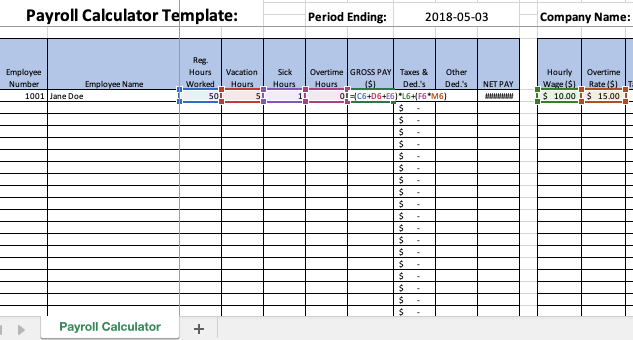

Payroll Template Free Employee Payroll Template For Excel

Excel Payroll Formulas Includes Free Excel Payroll Template

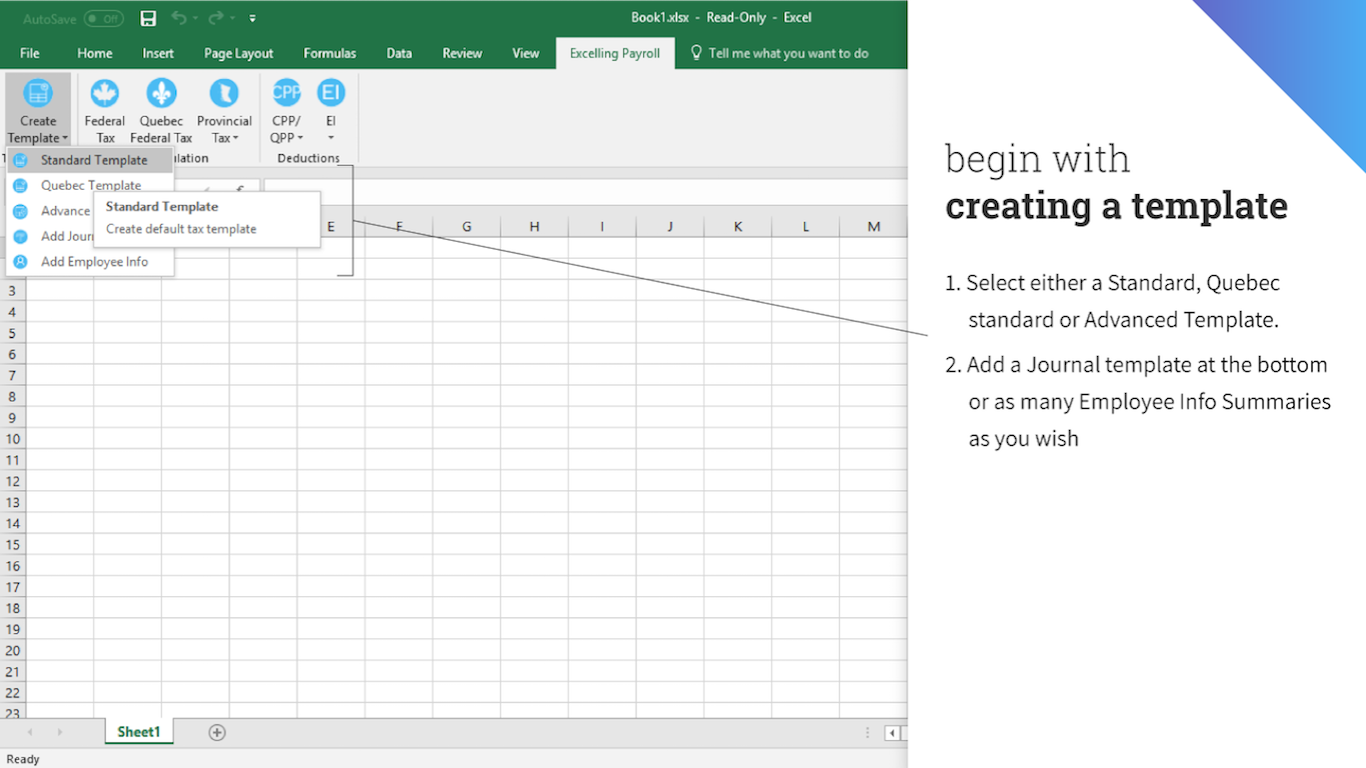

Find The Right App Microsoft Appsource

Enerpize The Ultimate Cheat Sheet On Payroll

Calculating Net Income Paychecks Payroll Taxes Deductions 2021 Updates

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator With Pay Stubs For Excel

Paycheck Calculator Take Home Pay Calculator

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator With Pay Stubs For Excel

Paycheck Calculator For Excel Paycheck Payroll Taxes Pay Calculator

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator Free Employee Payroll Template For Excel